Polymarket is a decentralized prediction market platform that operates using Polygon.

Recently, it gained significant attention by enabling users to bet on the outcomes of US political elections, a practice primarily prohibited within the traditional US betting framework.

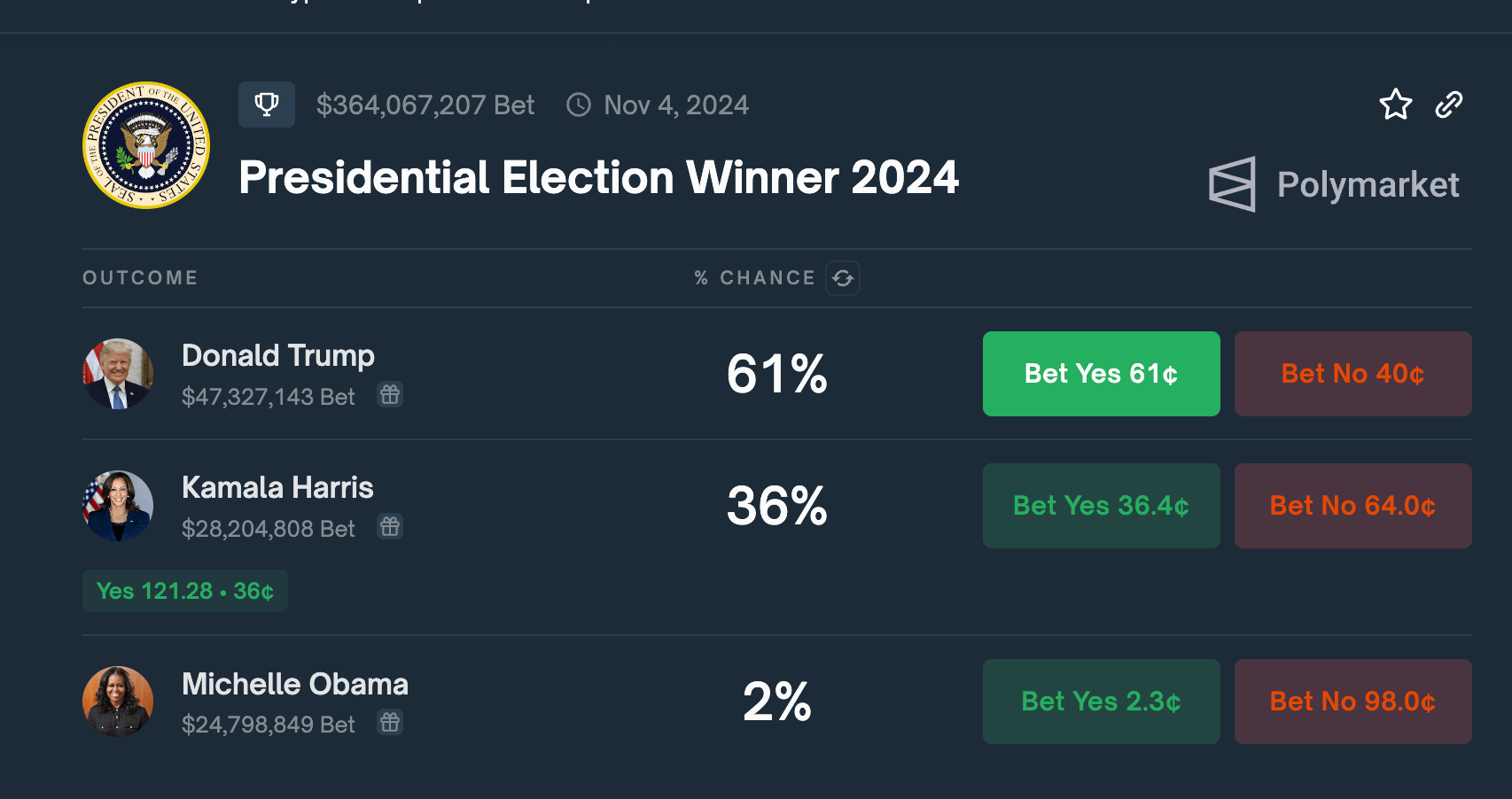

The platform’s market for the 2024 US Presidential Election, for instance, has seen substantial engagement, with over $364 million wagered on potential outcomes as of recent data. This surge in activity highlights a broader trend where prediction markets like Polymarket offer a unique avenue for political engagement and speculation, circumventing the restrictions imposed by US regulators on traditional betting platforms.

The Commodity Futures Trading Commission (CFTC) has actively worked to shut down or limit platforms offering election-related contracts, reflecting the contentious regulatory environment in which these markets operate. Despite these challenges, Polymarket’s innovative approach has positioned it as a key player in the global zeitgeist, particularly during high-stakes election cycles.

While Polymarket’s use is officially restricted in the US, access via VPN is still possible. Although this violates the site’s terms of use, many US betters may be capable of interacting due to the lack of KYC requirements, which would further limit accessibility.

Market Structure and Execution

Polymarket features binary outcome markets, where users can bet on “Yes” or “No” outcomes for various events. The platform uses a continuous double auction model, where prices represent the probability of an event occurring. For example, if “Yes” shares for an event are trading at $0.56, it implies a 56% probability of that outcome.

For example, to bet on the outcome of the 2024 US Presidential Election using Polymarket, users first connect their EVM-compatible wallet, such as MetaMask, and deposit USDC into their Polymarket account.

Once funded, users navigate to the market for the Presidential Election Winner 2024, where they can see the current probabilities for each candidate. For example, as of July 24, Donald Trump has a 61% chance of winning, with shares priced at $0.61 each.

Users can then buy “Yes” shares if they believe Trump will win or “No” shares if they think he will lose. If Trump wins, each “Yes” share will be worth $1, yielding a profit of $0.39 per share.

Conversely, if Trump loses, the “Yes” shares will become worthless. This dynamic allows users to trade their positions at any time before the market resolves, enabling them to lock in profits or minimize losses based on evolving probabilities.

Technical Infrastructure & Reward Mechanism

Polymarket leverages Polygon to enhance scalability and reduce transaction costs. This allows the platform to handle a high volume of trades without congesting the Ethereum network or incurring prohibitive gas fees.

The platform provides developers with REST and WebSocket API endpoints for accessing market data, prices, and order history. This enables the creation of third-party tools and integrations.

One of Polymarket’s novel features is its use of the UMA (Universal Market Access) Optimistic Oracle for market resolution. The process works as follows:

- When a market is created, a resolution request is sent to the UMA Optimistic Oracle.

- Users can propose a resolution to the request.

- A challenge period begins, allowing the proposed resolution to be disputed.

- If disputed, the resolution is submitted to UMA’s Data Verification Mechanism (DVM).

- UMA token holders vote to determine the correct outcome.

This decentralized approach ensures that market outcomes are resolved fairly and transparently without relying on a centralized authority.

Reward Mechanisms

Polymarket implements several incentive structures to encourage liquidity and participation:

- Liquidity Provider Rewards: Users who place resting limit orders near the market midpoint are eligible for weekly rewards. This program aims to create a healthy, liquid marketplace by incentivizing balanced quoting and discouraging exploitative behaviors.

- Order Scoring Function: Rewards are calculated using a complex formula considering factors such as market participation, two-sided depth, and spread from the midpoint. Each market has a configured max spread and minimum size cutoff for eligible orders.

- Weekly Distribution: Rewards are distributed directly to makers’ addresses weekly, typically on Fridays at midnight ET.

- Market-Specific Rewards: The reward amount is isolated per market, allowing for targeted incentivization of specific events or categories.

- Additional Incentives: Polymarket occasionally runs one-off public PnL/volume competitions to stimulate trading activity further.

Features and Advantages

Polymarket’s design offers several unique advantages:

- Real-time Trading: Users can enter and exit positions anytime, allowing dynamic market participation.

- No Native Token Requirement: Unlike some competitors, Polymarket doesn’t require users to hold or earn a native platform token to participate.

- Self-Custodial Wallets: Users maintain control of their funds, enhancing security and reducing counterparty risk.

- Wide Range of Markets: The platform supports markets on various topics, including politics, sports, entertainment, and more.

- Scalability: By leveraging Polygon, Polymarket can handle high transaction volumes with low fees.

- Transparent Price Discovery: The continuous double auction model provides precise, real-time probabilities for event outcomes.

Polymarket combines blockchain, side chain scaling, decentralized oracles, and innovative reward mechanisms to create a robust and efficient prediction market platform. Its design allows for real-time trading, transparent price discovery, and fair market resolution while incentivizing liquidity and participation.

The post How does Polymarket’s $364 million US election crypto prediction market work? appeared first on CryptoSlate.