Dogecoin (DOGE) is getting battered by the recent crypto market downturn. The meme-based cryptocurrency took a significant hit this Thursday, dropping 14% in value in the last 24 hours.

Long Positions Liquidated

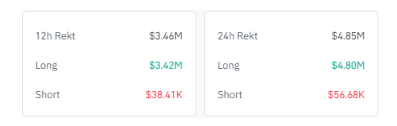

According to Coinglass, a crypto derivatives data platform, DOGE saw a whopping $4.8 million in long positions liquidated. This signifies that investors who bet on DOGE’s price increase got squeezed as the price went down. Conversely, short positions (bets on a price decrease) saw minimal liquidations at just $56,680.

This liquidation event coincides with a major price drop for DOGE, pushing it to a three-month low. The price currently sits between $0.099 and $0.117, a crucial support zone identified by IntoTheBlock, a blockchain analytics firm. This zone represents a large number of wallets holding DOGE, and if it holds, the price could potentially rebound towards $0.142.

Dogecoin Not Alone, But A Leader In Liquidations

While DOGE is feeling the heat, it’s not the only cryptocurrency facing liquidation woes. The broader market correction resulted in over $321 million in total liquidations across various cryptocurrencies.

LIQUIDATION DATA IN 24 HOURS

TOTAL LIQUIDATIONS: UP TO $321.28M

TOP 5 COINS WITH HIGHEST LIQUIDATION:$BTC ~ $91.51M $ETH ~ $71.90M$SOL ~ $12.84M $DOGE ~ $5.39M $WLD ~ $5.23M #Blockchain #DeFi #liquidation pic.twitter.com/e6Dv5uQbkn

— PHOENIX – Crypto News & Analytics (@pnxgrp) July 4, 2024

Interestingly, DOGE takes the fourth spot for most significant liquidations, surpassing bigger players like Solana (SOL). Even younger meme coins like Dogwifhat (WIF) and Pepe (PEPE) haven’t been spared, experiencing significant liquidations as well.

Dogecoin, despite its recent struggles, remains a significant player in the crypto market. It operates on the Litecoin blockchain, a well-established technology, and boasts of over $13 billion market capitalization.

A Double-Edged Sword: No Spot Market Pressure, But High Bitcoin Correlation

There’s a silver lining for DOGE. Unlike the derivatives market, the spot market (where actual buying and selling of crypto happens) doesn’t seem to be experiencing significant selling pressure. Data shows that DOGE buy orders are actually outpacing sell orders by nearly $1 million.

However, DOGE’s fate seems intertwined with Bitcoin (BTC). They share a very high price correlation, meaning even minor sell-offs in Bitcoin can significantly impact DOGE’s price. Recent events like potential sell-offs from Mt. Gox, a defunct crypto exchange, and the German government selling confiscated Bitcoin, could indirectly affect DOGE’s price.

Will DOGE Rebound?

Meanwhile, Dogecoin’s technical indicators are leaning bearish. The price prediction of a 13% drop by August 4th aligns with the current sentiment. The Fear and Greed Index at 29 further reinforces this bearish outlook.

Additionally, despite having a third of the last 30 days in positive territory, Dogecoin still experienced significant price volatility, which could indicate a continuation of the downtrend.

Featured image from Unsplash, chart from TradingView