Quick Take

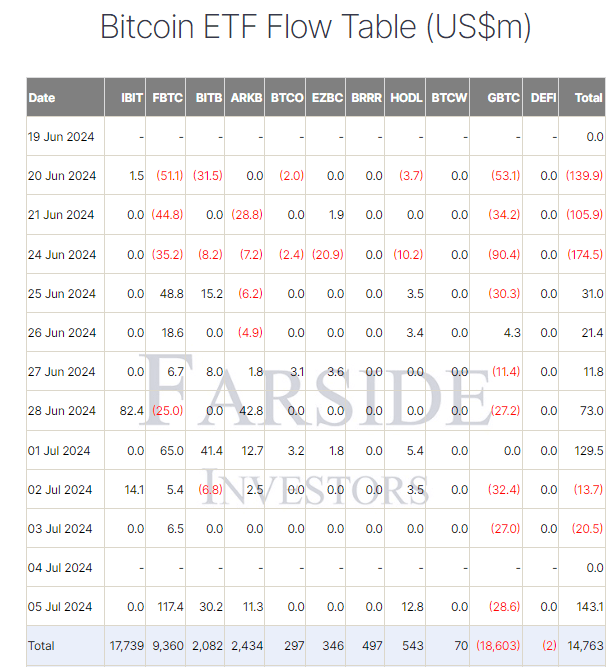

Farside data shows that on July 5, Bitcoin ETFs experienced a significant inflow of $143.1 million, the largest inflow since June 6.

Fidelity’s FBTC led the charge with an inflow of $117.4 million, bringing its total inflow to $9.4 billion. Bitwise’s BITB saw an inflow of $30.2 million, pushing its total net inflow to $2.1 billion, while Vaneck’s HODL recorded a $12.8 million inflow, the largest since May 24, taking its total to $543 million. Notably, no outflows occurred from the Newborn Nine ETFs, with the only outflow from Grayscale GBTC, with total net inflows across all ETFs of $14.8 billion.

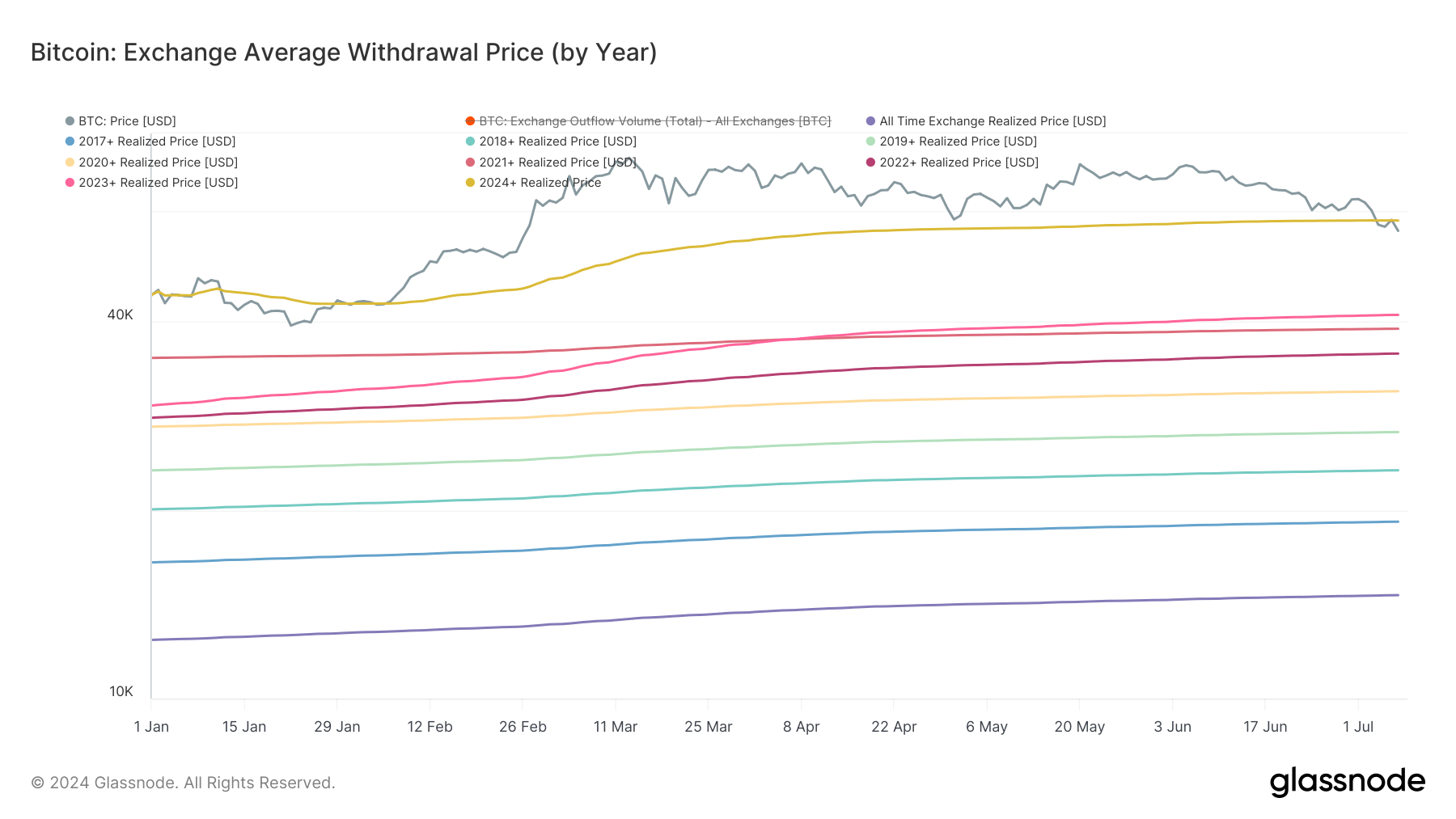

CryptoSlate reported that the 2024 ETF buyer’s realized price is around $58,000. With Bitcoin trading below this threshold on July 4 and 5 and remaining below it currently, ETF buyers are, on average, underwater for the first time since the January launch.

This situation led to a debate between analyst Jim Bianco and CryptoSlate lead analyst James Van Straten about the potential market reaction if Bitcoin fell below this cost basis. Contrary to Bianco’s prediction of aggressive outflows, the market has not yet seen such a reaction, indicating resilience among ETF investors.

The post Resilient ETF investors defy bearish predictions despite Bitcoin trading below $58,000 appeared first on CryptoSlate.