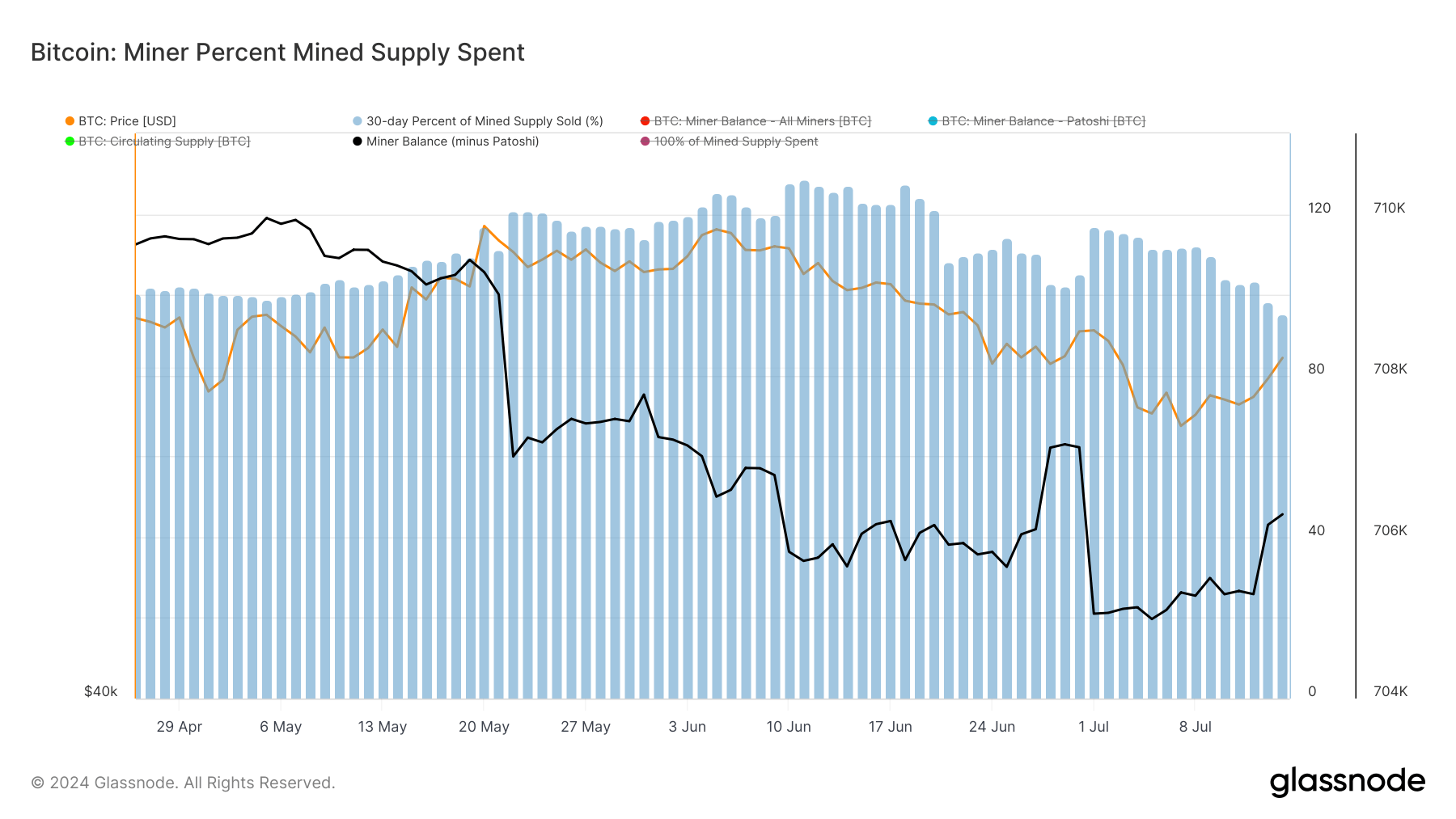

Bitcoin miners have reduced their selling activity, with $62 million worth of Bitcoin currently being held as the price surpasses $62,000. Post-April 2024 halving, miners initially escalated their selling to manage operational costs due to halved rewards.

The chart from Glassnode illustrates a noticeable decrease in the 30-day percent of mined supply sold, coinciding with a recovery in miner balances. This trend indicates a potential shift towards hodling despite the reduced block rewards. The black line representing miner balances (excluding Patoshi) shows an upward trajectory, reflecting increased accumulation by miners. Meanwhile, the orange line indicating Bitcoin price displays a steady upward movement, reinforcing the potential profitability in holding rather than selling immediately.

This strategic shift in miner behavior aligns with historical trends, where miners hold more during bullish periods to maximize profits. The current data suggests that miners are optimistic about future price appreciation and opt to retain more of their mined Bitcoin.

The post Miner selling slows with reserves increasing by $62 million BTC appeared first on CryptoSlate.