Quick Take

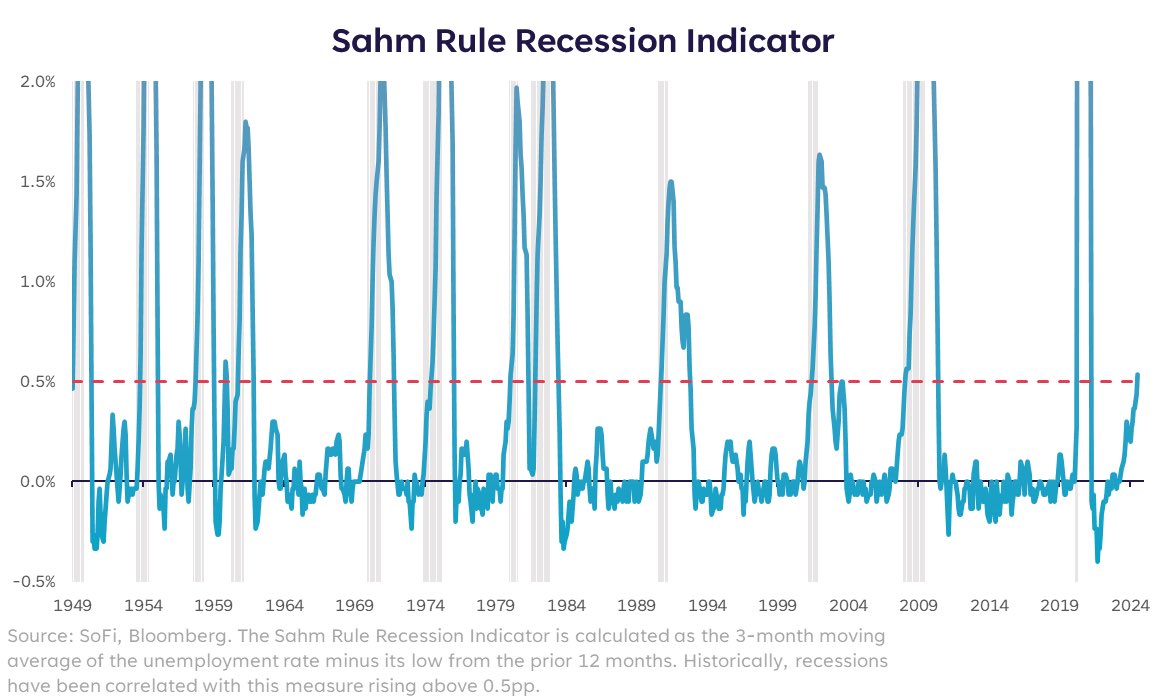

Following a disappointing US jobs report, which revealed an unemployment spike to 4.3% and the addition of just 114,000 jobs, the Sahm Rule has been triggered, according to Head of Investment Strategy Liz Thomas at SoFi.

Based on the unemployment rate, this indicator signals a recession is already underway if the unemployment rate, calculated using a three-month moving average, rises by half a percentage point from its lowest point in the past year.

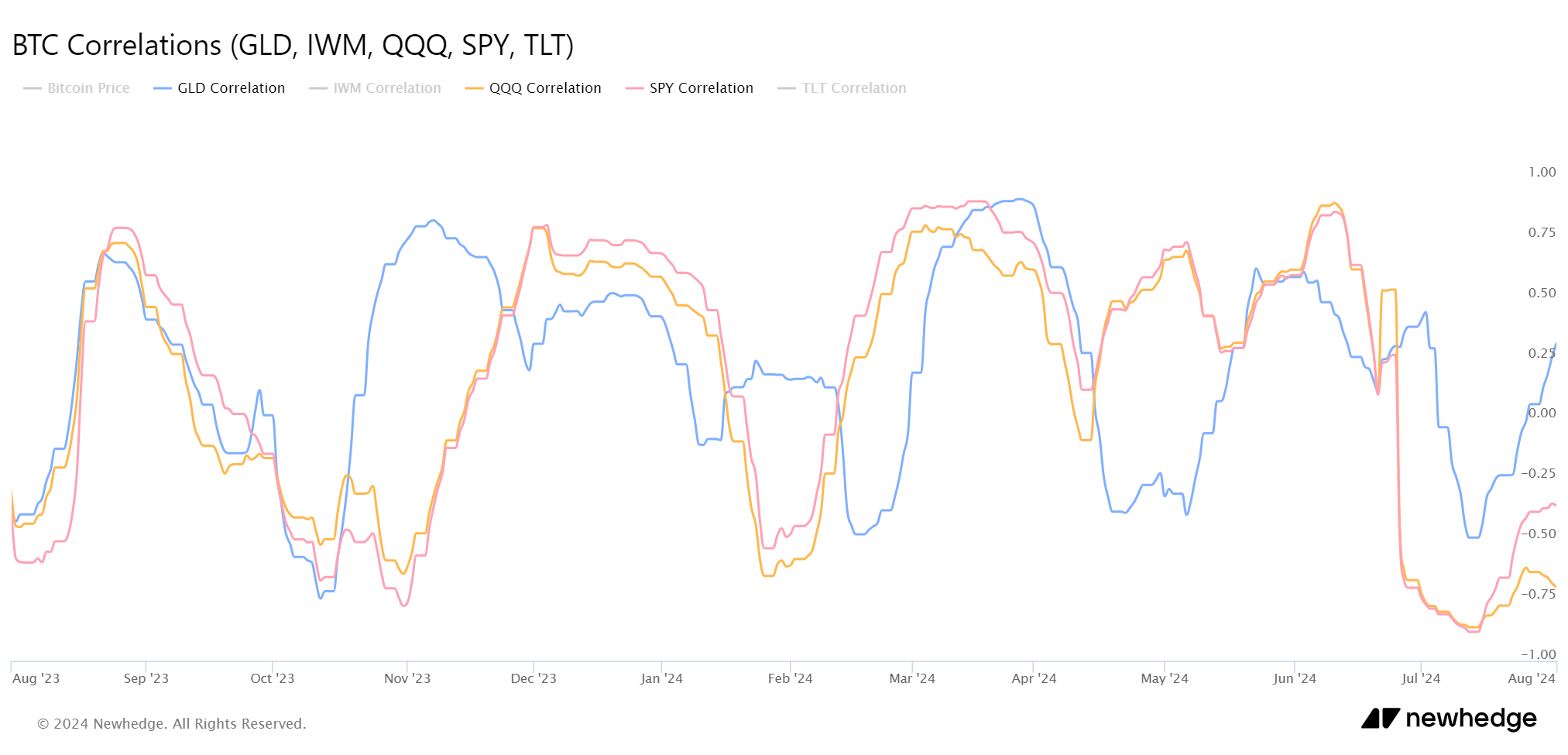

Despite the bad jobs report, Bitcoin remains resilient and maintained a strong position at around $65,000 before US markets opened. Since it has fallen to around $63,700 as of press time. According to Newhedge data, Bitcoin’s 30-day rolling correlation with major equity indices QQQ and SPY is in negative territory. This decoupling suggests that Bitcoin is not following as steep a downward trend as US equities. Additionally, Bitcoin’s correlation with gold has increased to 0.32 from negative levels just a few weeks ago, indicating a stronger relationship with the traditional safe-haven asset.

Gold is also performing well, trending upwards by 1% on Aug. 1 and nearing the $2,500 per ounce mark.

The post Bitcoin’s correlation with gold strengthens amid recessionary signals appeared first on CryptoSlate.