On-chain Highlights

DEFINITION: Skew is the relative richness of put vs call options, expressed in terms of Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility. 25 Delta Skew is calculated as the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility, normalized by the ATM Implied Volatility. This metric focuses on option contracts expiring in 6 months.

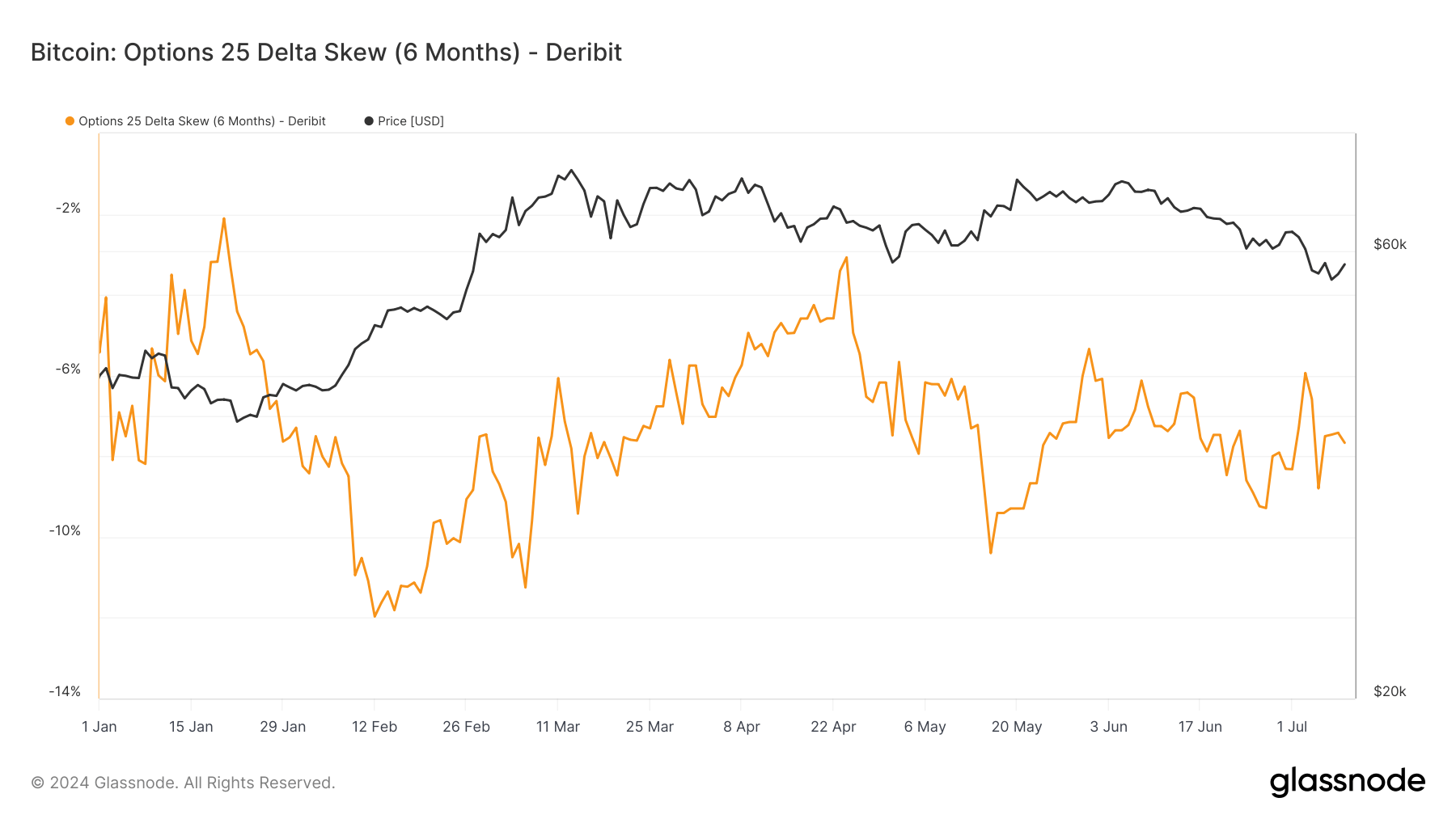

Bitcoin’s 25 Delta Skew for options expiring in six months has shown notable fluctuations recently. The metric has moved significantly since January 2024. Initially, the skew was around -6%, indicating a preference for puts. By late February, it dipped further to -12%, suggesting a bearish sentiment.

A skew of -12% means that the implied volatility for the put options (with a delta of -25%) is 10% lower than the implied volatility for the call options (with a delta of 25%).

Implied volatility measures how much the market expects the underlying asset’s price to move. If puts have lower implied volatility than calls, it suggests that the market expects less downward movement (or risk) in the underlying asset’s price compared to upward movement.

This difference is then normalized by the ATM implied volatility, which is the implied volatility for options where the strike price is roughly equal to the underlying asset’s current price.

Following the April 2024 halving, the skew maintained a put premium, reflecting a slight bearish sentiment. The price of Bitcoin corresponded with a drawdown, peaking near $70,000 in mid-March before stabilizing around $55,000 by July.

This recent trend suggests a bearish outlook among options traders.

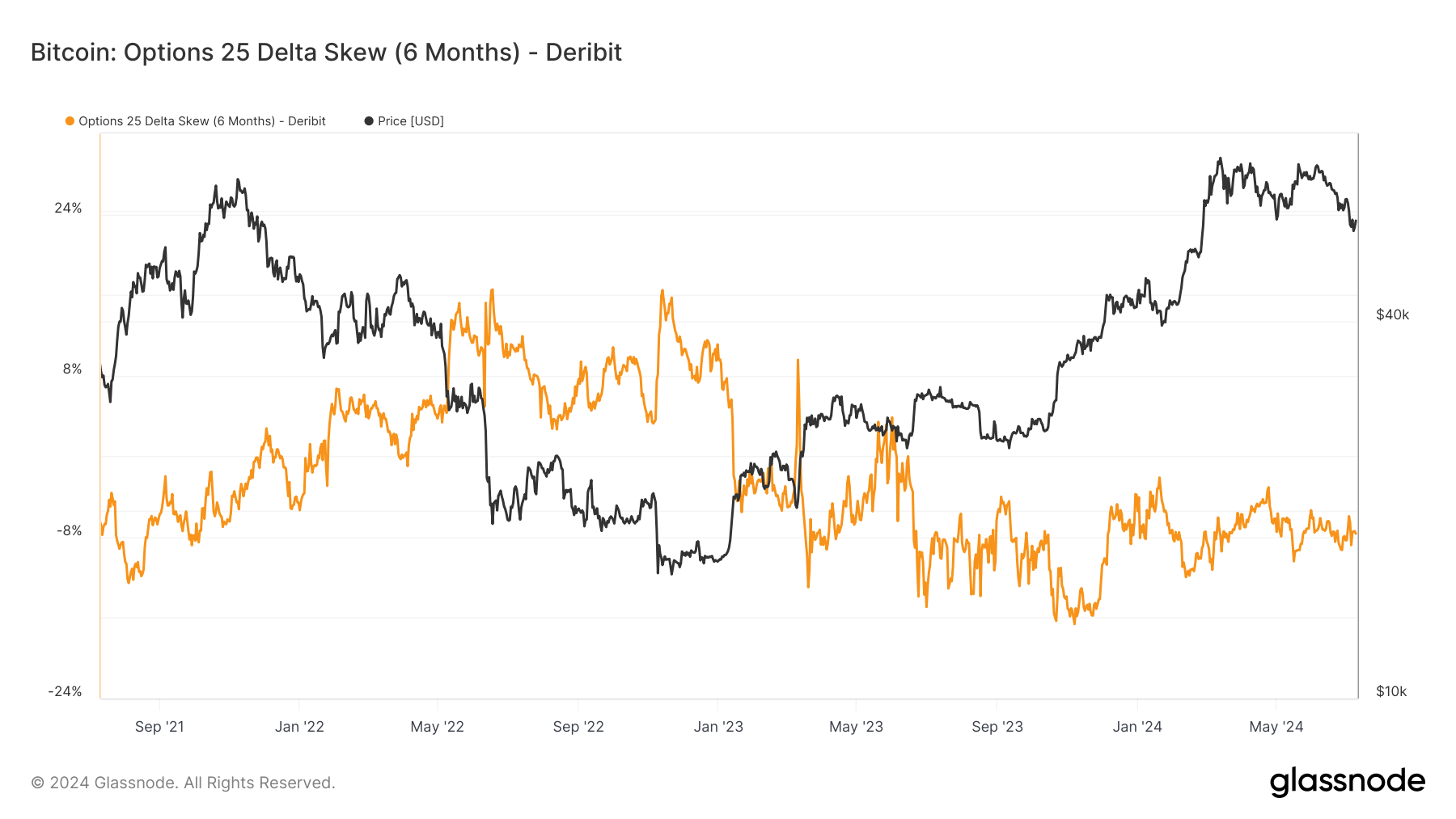

Historically, the skew hit an all-time high in late 2022 at the bottom of the market and its lowest in late 2023 when BlackRock filed for its spot Bitcoin ETF. The skew has only been positive for around 10 months in total since 2021, with an overall trend leaning toward bearish. Part of this reason may also be due to investors using options contracts to hedge long purchases.

The post Bitcoin’s post-halving price fluctuations mirror cautious market sentiment in options appeared first on CryptoSlate.