For the crypto and broader financial market, FOMC day is upon us once again today. And analysts agree that today’s meeting will be one of the most important in recent years. Kurt S. Altrichter, a financial advisor and founder of Ivory Hill, even describes today’s FOMC meeting as the “most important of your life.” In a new post on X, Altrichter explains why.

FOMC Preview

Central to today’s FOMC meeting is the Federal Reserve’s potential indication of a September rate cut. According to Altrichter, the financial markets are almost unanimously anticipating this move, with Fed fund futures indicating a near-certain likelihood of such an outcome. “Market expectation is a strong signal for a September rate cut,” Altrichter points out, marking today’s update as a pivotal moment for financial markets.

The key question for today is: “How strongly does the Fed signal a September rate cut?” the expert explains. Investors are directed to pay close attention to the FOMC’s statement at 2:00 pm ET, especially the third paragraph, which could subtly signal the Fed’s confidence in reaching its inflation targets.

Altrichter advises, “Look at the 3rd paragraph for this key sentence: The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” Any modification in this wording would be a clear signal that the Fed is nearing its inflation control goals, potentially paving the way for rate adjustments.

Altrichter outlines several potential outcomes from the meeting, each associated with specific market reactions. In a dovish scenario, the Fed signals a rate cut for September. Then, Altrichter expects a broad market rally, especially in sectors less sensitive to interest rates. “Yields and the dollar should fall modestly with a modest rally in commodities,” Altrichter predicts, suggesting significant movements in standard and sector-specific indexes.

In a hawkish scenario, there will be no change in the forward guidance by the US central bank. If the Fed maintains its current stance without hinting at future cuts, the markets might experience a downturn. “Look out below and expect a sharp decline. SPX should fall by 1-2%,” he warns, noting that tech and growth sectors might relatively outperform due to their appeal during higher yield periods.

How Will Bitcoin And Crypto React?

The potential adjustments in US monetary policy bear direct consequences for the Bitcoin and crypto markets. Crypto, often viewed as alternative investments, reacts sensitively to shifts in monetary policy, particularly regarding interest rates.

If the dovish scenario materializes, this could make Bitcoin and cryptocurrencies more appealing. A signal of lower future rates could drive increased investment into the crypto market, potentially leading to price increases as investors seek higher returns in alternative assets.

Conversely, should the Fed signal reluctance to cut rates, indicating a stronger economic outlook or concerns about inflation, this could strengthen the US dollar and increase yields on traditional financial instruments. Such an environment might lead to a pullback in the crypto markets, as the comparative advantage of Bitcoin and cryptocurrencies diminishes against strengthening traditional yields.

Max Schwartzman, CEO of Because Bitcoin Inc, commented via X: “FOMC is [today] & its incredibly important as we get into the end of this fed cycle… Here is how the last 11 meetings have gone for Bitcoin…”

Thus, today’s FOMC meeting is a watershed moment for financial markets globally, with significant implications for both traditional and crypto markets. As Altrichter succinctly puts it, “A Sept Fed rate cut has driven the 2024 bull market. Tomorrow’s meeting will either reinforce that tailwind or refute it. If the Fed signals a cut, the rally continues. No signal: markets could get ugly.”

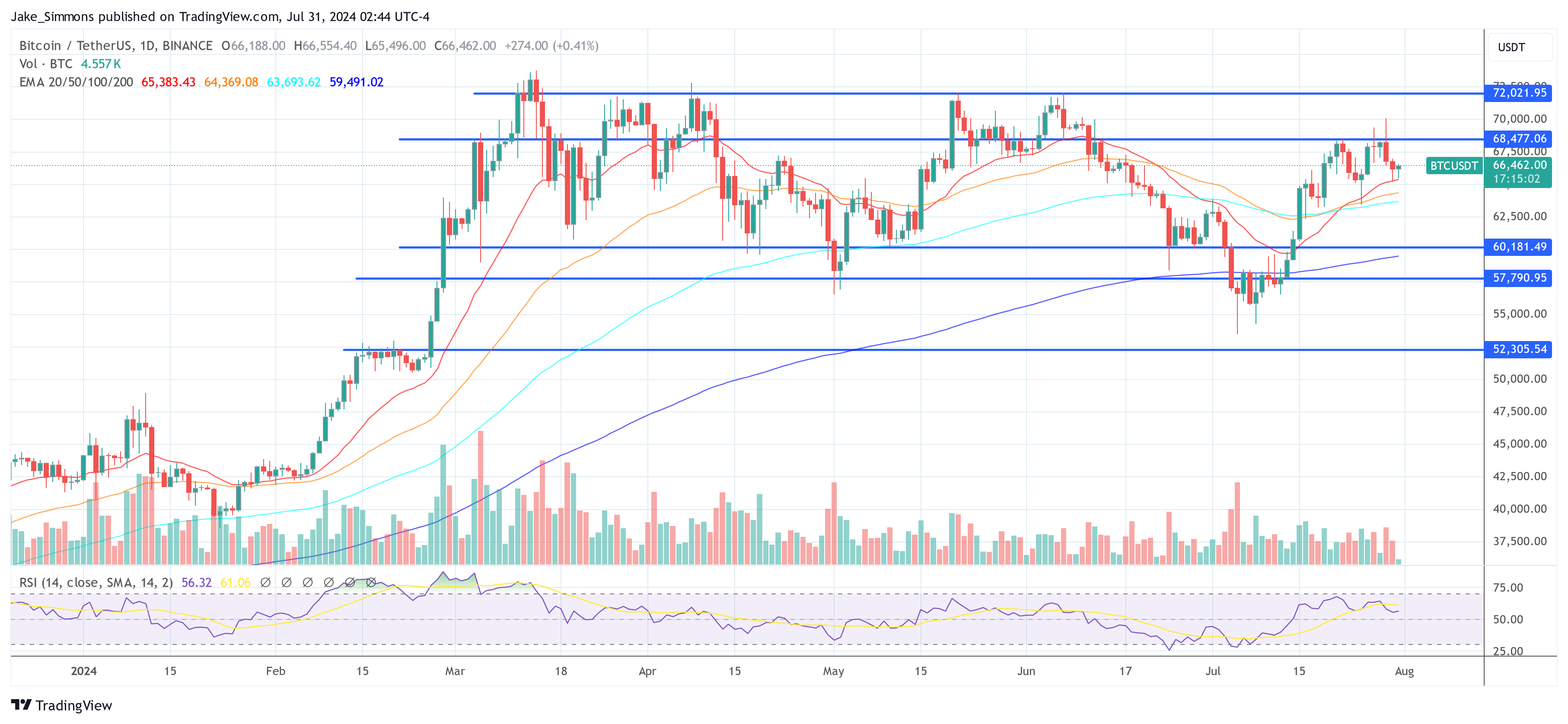

At press time, BTC traded at $66,462.