Quick Take

Bitcoin

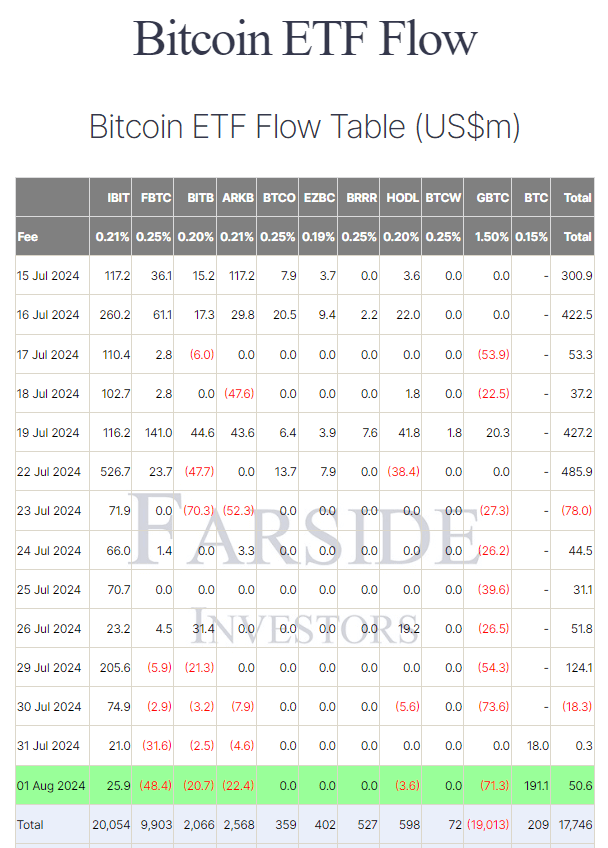

Farside data reveals inflows into the Bitcoin exchange-traded funds (ETFs) on Aug. 1 with the overall net inflow being $50.6 million. Grayscale BTC, the more affordable option at 15 basis points, attracted a substantial $191.1 million inflow. Conversely, the pricier GBTC, at 150 basis points, experienced an outflow of $71.3 million, contributing to a cumulative net outflow of $19 billion for the ETF.

Among the top ETF issuers, three continue to see persistent outflows. Fidelity’s FBTC witnessed a $48.4 million outflow, Bitwise’s BITB had a $20.7 million outflow, and ARK’s ARKB experienced a $22.4 million outflow. Notably, these issuers have not seen any inflows since July 26, potentially linked to the launch of the mini BTC ETF being a cheaper product. Despite these trends, BlackRock’s IBIT continued its positive trajectory with a $25.9 million inflow, bringing its total inflow to $20.1 billion.

These ETF movements occurred amidst a significant Bitcoin price decline, with BTC falling below $63,000.

Ethereum

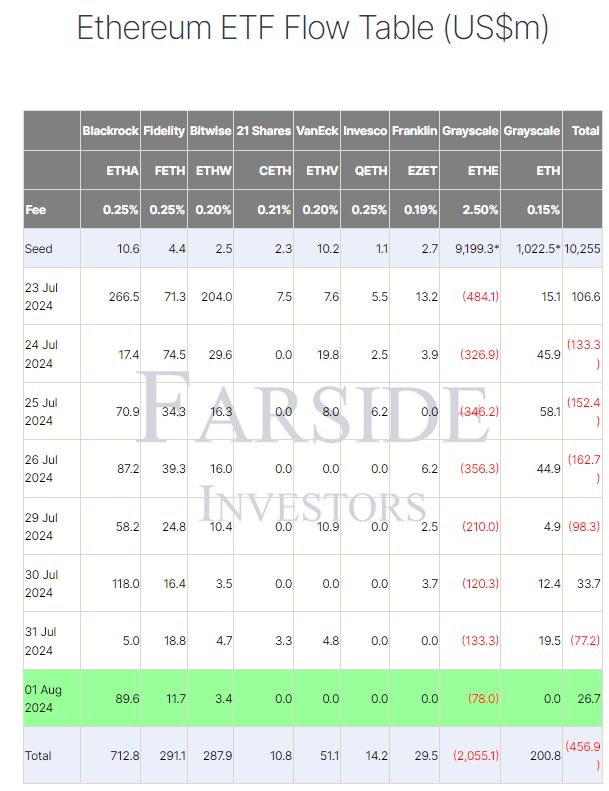

Farside data shows that Ethereum ETFs also saw inflows on Aug. 1, with a net inflow of $26.7 million. BlackRock’s IBIT led the way with $89.6 million in inflows, while Grayscale ETHE continued to struggle, facing outflows of $78.0 million. Ethereum ETFs have now seen a total outflow of $456.9 million.

The post Grayscale BTC attracts $191 million inflow amid continued outflows in other Bitcoin ETFs appeared first on CryptoSlate.