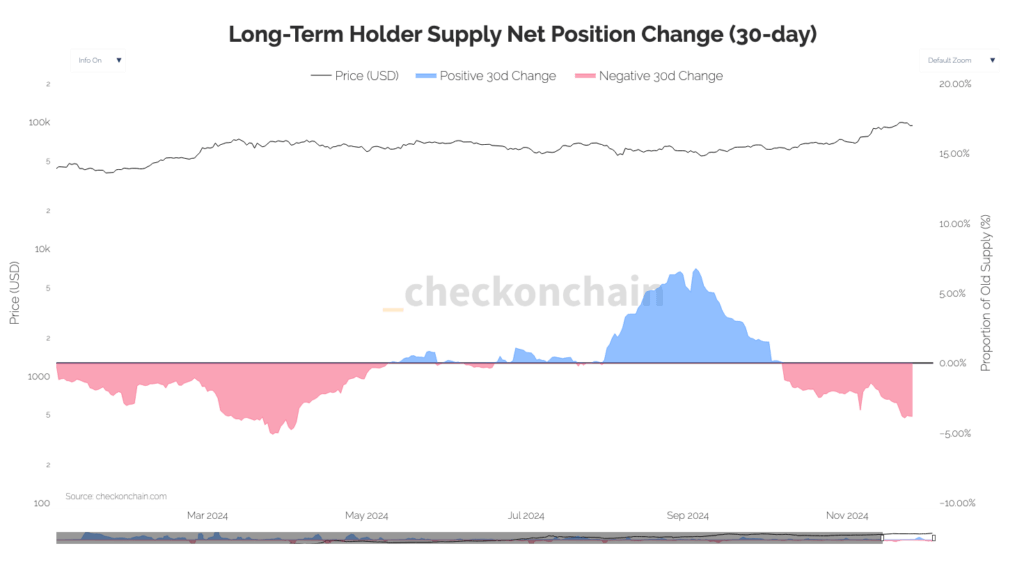

Long-term Bitcoin holders shifted from accumulation to distribution as the price neared $100,000. Data on the Long-Term Holder Supply Net Position Change shows that after accumulating from May to August 2024, holders began distributing assets in late September.

The net position change indicates that long-term holders were net sellers from March to May, possibly due to profit-taking. The subsequent accumulation phase may have contributed to price increases by reducing market supply. The recent distribution suggests holders are realizing profits amid Bitcoin’s ascent toward the six-figure mark.

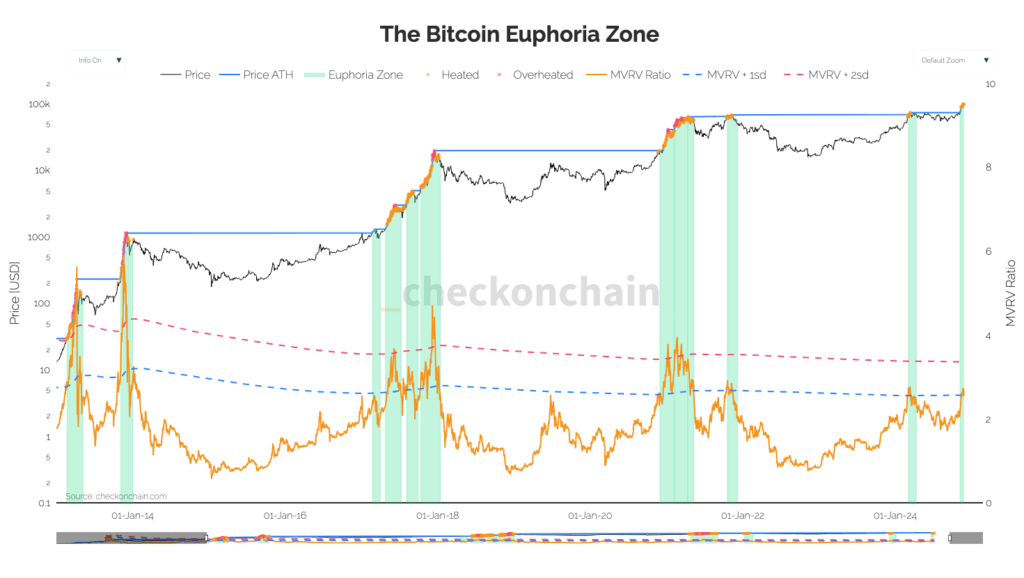

Additionally, the Market Value to Realized Value (MVRV) Ratio has entered the euphoria zone, historically associated with overheated markets. Periods when the MVRV Ratio exceeds the upper threshold often precede corrections, as seen in previous peaks. The current ratio suggests heightened speculative activity and the potential risk of a price correction.

Bitcoin’s price surged to $98,200 on Nov. 21 before retracing to around $97,000, bringing it within 3% of the $100,000 milestone. The appreciation follows events like the U.S. election results in November 2024 and the halving in April.

As of press time, Bitcoin is struggling to retest the $100,000 milestone, trading at around $93,400.

The post Long term holders take profits as Bitcoin drops to $93k appeared first on CryptoSlate.